"Having worked for a gay-friendly CPA firm near West Hollywood for almost 10 years, I have learned to work with the gay community. I have learned how fun, diversed, talented, hard-working, and interesting the community is. Now that I have my own firm, I would like to continue my experience of serving them!"

We are a full service CPA firm, tax preparers, tax accountants, Quickbooks & payroll consultants, business managers and consultants based in Torrance, CA near Los Angeles, Long Beach & OC, serving the entire U.S., and serving the LGBT community - Lesbian, Gay, Bisexual, and Transgender Community.

Same-Sex Marriage Tax Update!

The U.S. Department of the Treasury and IRS announced that all legal same-sex marriages will be recognized for federal tax purposes. Revenue Ruling 2013-17 in 2013-38 IRB 201 effective September 16, 2013 provides certainty, benefits and protections under federal tax law for same-sex married couples.

You may get a refund if we amend you prior tax returns, within the statute of limitations, if you file married filing joint as opposed to single. We may also exclude health benefits that you or your employer paid for your spouse from your taxable income. Thus, you may get a refund.

Frequently asked questions for individuals of the same sex who are married under state law that are recognized for federal tax purposes:

1. When are individuals of the same sex lawfully married for federal tax purposes?

2. Can same-sex spouses file federal tax returns using a married filing jointly or married filing separately status? Can they file head of household?

3. Can a taxpayer and his or her same-sex spouse file a joint return if they were married in a state that recognizes same-sex marriages but they live in a state that does not recognize their marriage?

4. Can a taxpayer’s same-sex spouse be a dependent of the taxpayer?

5. If same-sex spouses (who file using the married filing separately status) have a child, which parent may claim the child as a dependent?

6. Do provisions of the federal tax law such as of community income apply to same-sex spouses?

7. If an employer provided health coverage for an employee’s same-sex spouse and included the value of that coverage in the employee’s gross income, can the employee file an amended Form 1040 reflecting the employee’s status as a married individual to recover federal income tax paid on the value of the health coverage of the employee’s spouse?

8. If an employer sponsored a cafeteria plan that allowed employees to pay premiums for health coverage on a pre-tax basis, can a participating employee file an amended return to recover income taxes paid on premiums that the employee paid on an after-tax basis for the health coverage of the employee’s same-sex spouse?

There are many more questions that we can answer for you. Give us a call and we will be happy to help!

We are a full service CPA firm, tax preparers, tax accountants, Quickbooks & payroll consultants, business managers and consultants based in Torrance, CA near Los Angeles, Long Beach & OC, serving the entire U.S., and serving the LGBT community - Lesbian, Gay, Bisexual, and Transgender Community.

Vincent B. Ladinez, CPA, MBA

Owner & President

Vincent B. Ladinez has over 10 years of tax and accounting experiences. He has prepared thousands of personal and business tax returns; he has successfully represented his clients before the IRS for tax audits; he has successfully removed bank levies, wage garnishment and tax liens; he has successfully negotiated and reduced tax debts; he has helped entrepreneurs start and grow their businesses.

His main goals are to minimize your tax exposure, solve your tax problems, help start and grow your business. He strives to offer fast, friendly, and personalized tax and accounting services.

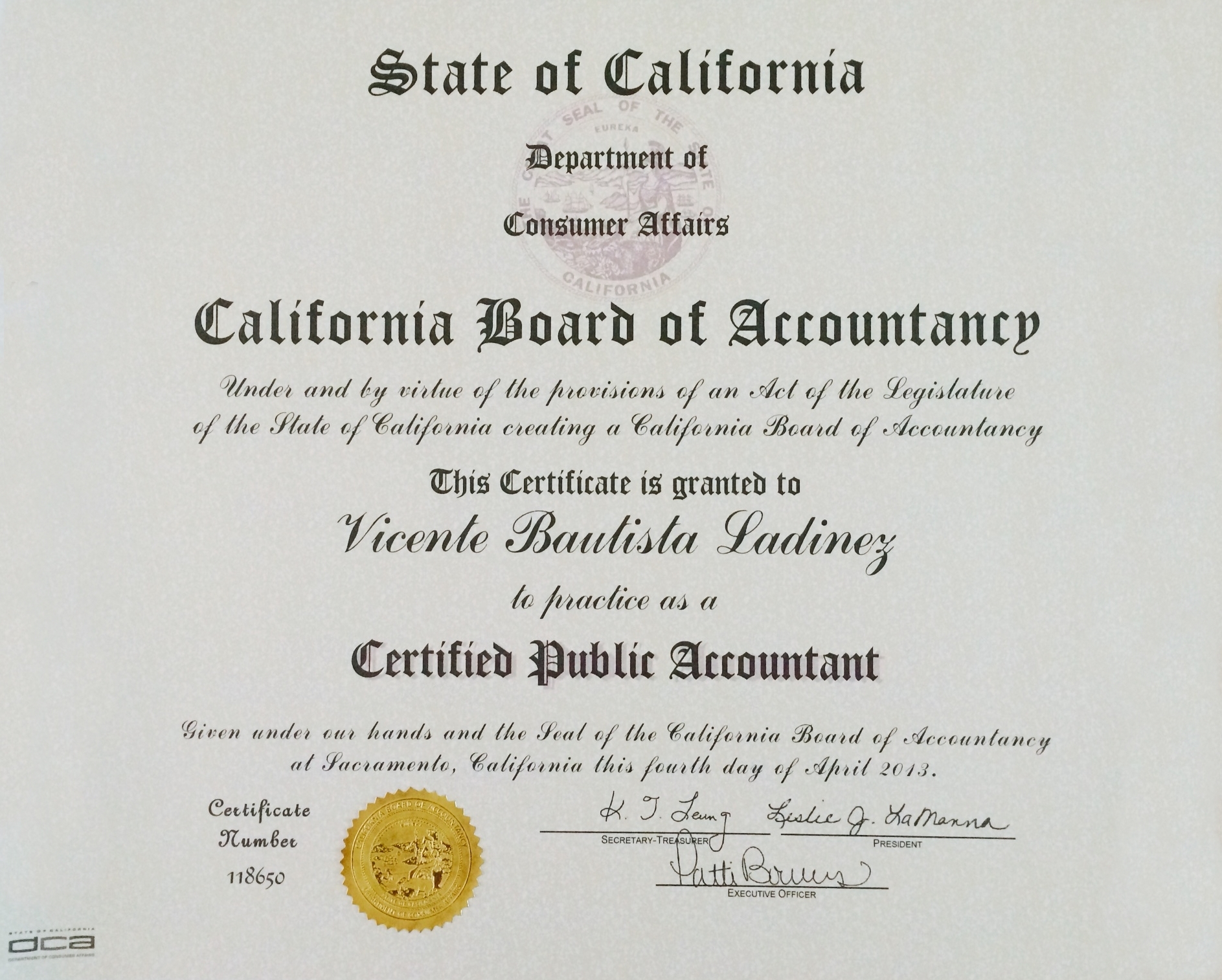

Certified Public Accountant certificate granted by the California Board of Accountancy.

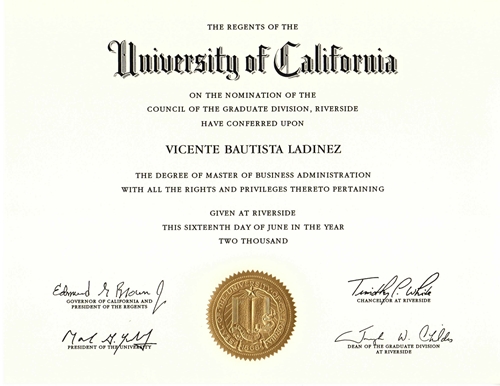

Inspired by his uncle, who owned a successful manufacturing business, he entered business school at The A. Gary Anderson Graduate School of Management at the University of California, Riverside (UCR), where he received the Degree of Master in Business Administration (MBA) in 2000. There, he was exposed to a very diverse group of international students from different countries of Asia, Europe, South America, and the Middle East.

He received the degree of Master of Business Administration from The A. Gary Anderson Graduate School of Management, UC Riverside.

Prior to working for a public accounting firm in 2003, Vicente has had good amalgam of financial and accounting professional experiences. He had worked as an accountant for Los Angeles City’s Finance Department. He had worked as a financial research analyst for Thomas F. White & Company, Inc., a discount brokerage company. Shortly after, he had taken a job as a cost accountant and a logistics analyst at Daylight Transport, an LTL carrier company.

Through Volunteer Income Tax Assistance (VITA), Mr. Ladinez used to offer free tax assistance to those who are needy and lederly.

While an associate for various public accounting firms, he initially concentrated on taxation. He eventually carried the responsibility of business management for the firm’s certain closely held businesses. He then was assigned consulting capacity to clients and acted as interim controller as well as general external finance support to clients in a regular basis.

Vicente …or Vince, Vincent, Vinnie, enjoys playing guitar with his buddies and likes the beach, as it reminds him of his childhood.

We are a full service CPA firm, tax preparers, tax accountants, Quickbooks & payroll consultants, business managers and consultants based in Torrance, CA near Los Angeles, Long Beach & OC, serving the entire U.S.